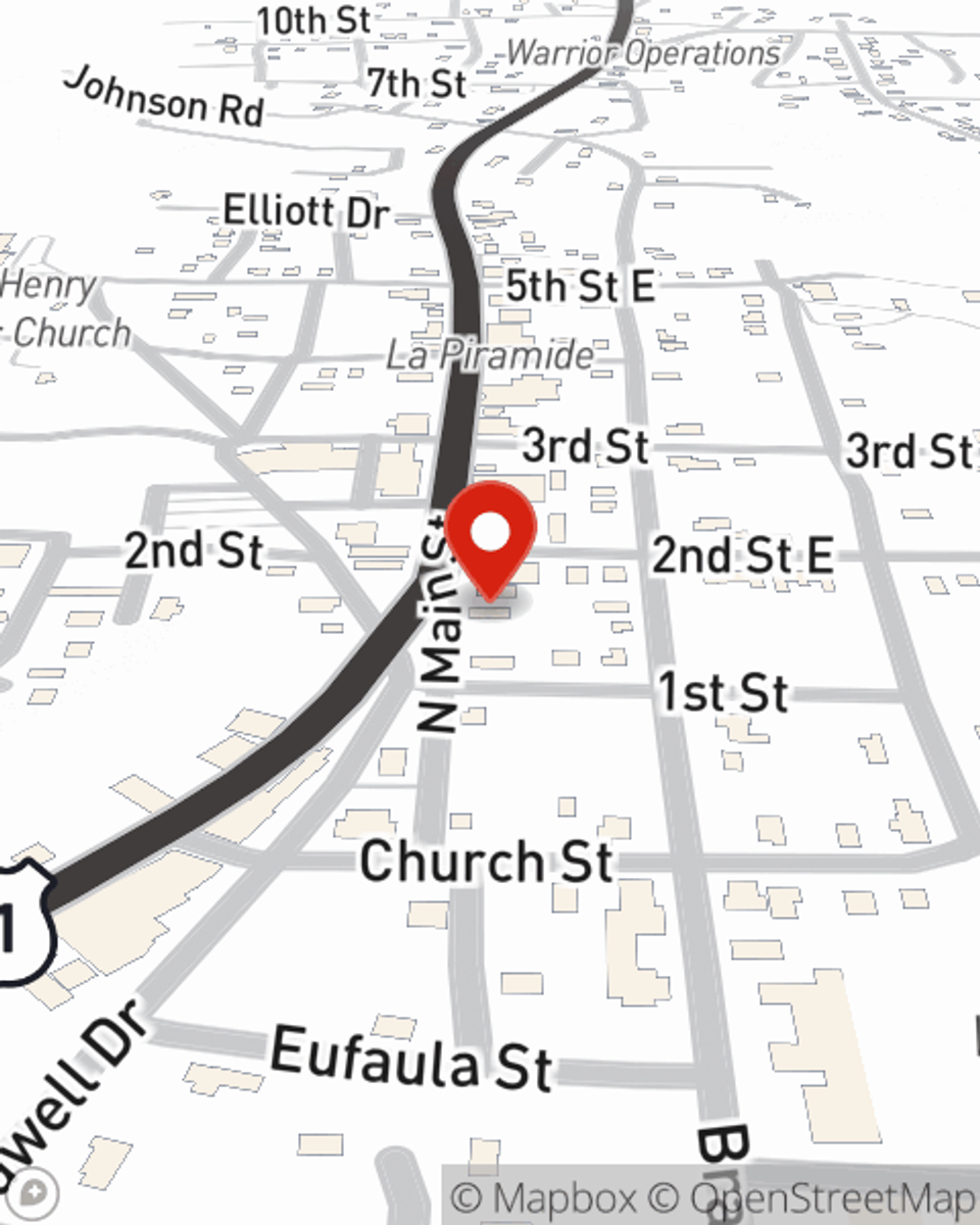

Business Insurance in and around Warrior

Researching insurance for your business? Look no further than State Farm agent Stewart Lee!

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to consider. You're in good company. State Farm agent Stewart Lee is a business owner, too. Let Stewart Lee help you make sure that your business is properly covered. You won't regret it!

Researching insurance for your business? Look no further than State Farm agent Stewart Lee!

This small business insurance is not risky

Keep Your Business Secure

If you're looking for a business policy that can help cover business liability, loss of income, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Visit the exceptional team at agent Stewart Lee's office to identify the options that may be right for you and your small business.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Stewart Lee

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.